Insights and Resources

Content Type:

Industry:

- All

- Asset management

- Automotive

- Business and Professional Services

- Consumer Goods

- Consumer Products

- Energy

- Financial Services

- Food and Beverage

- Government

- Health Care

- Healthcare

- Hospitals and Health Systems

- Insurance Industry

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Restaurant

- State and Local

- Tech Media Telecom

Service:

- All

- Audit

- Business Strategy

- Business Tax

- Compensation and Benefits

- Credits and Incentives

- Cybersecurity Risk

- Digital Transformation

- Federal Tax

- Financial Consulting

- Financial Management

- Global Audit

- Global Compliance and Reporting

- International Services

- International Tax Planning

- Managed Services

- Private Client

- Public Companies

- Risk Consulting

- State and Local Tax

- Tax

- Technical Accounting Consulting

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Base Erosion and Profit Shifting (BEPS)

- CARES Act

- Coronavirus

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Evolution

- Economics

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Global Compliance

- Inflation

- Labor and Workforce

- Partnership

- Payroll and Employment

- Policy

- Regulations and Compliance

- Regulatory Compliance

- SEC Matters

- Supply Chain

- Tax Reform

Properly Funding Your Living Trust

Failing to properly fund a living trust is one of the most common errors people make and can lead to unintended consequences and added costs for both the individual and their beneficiaries. In this video, we'll provide an overview of how to properly fund a living trust.

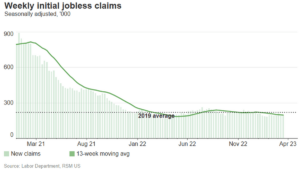

Initial jobless claims drop further

Initial claims for unemployment benefits fell by 1,000 to 191,000 last week, remaining below the pre-pandemic average and below expectations of a slight increase to 197,000.

CHP Energy Solutions’ digital transformation is on a mission

By working with RSM’s team of experienced Microsoft advisors, CHP Energy Solutions’ digital transformation elevated its operations and energized its staff. Its noble 50-year mission has been modernized, making teams and processes more efficient while providing a path to scale up and serve more households and communities.

How hedge funds achieve alignment with investors

Find out more about how hedge fund managers are adapting their business model in response to competition and the evolving mandates of investors and competition.

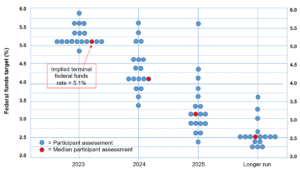

Catch-25: Fed hikes rates amid financial stability risk

The Federal Reserve finds itself as it lifted its policy rate by 25 basis points on Wednesday amid a quickly evolving global banking crisis.

Taking action: What financial institutions can do in the wake of bank failures

Financial institutions need to understand what led to the recent failures of Silicon Valley Bank, Signature Bank of New York and Silvergate Bank so they can enhance their organizations' risk management activities and meet increased regulatory expectations while also maintaining customer confidence.

Taking action: What financial institutions can do in the wake of bank failures

Financial institutions need to understand what led to the recent failures of Silicon Valley Bank, Signature Bank of New York and Silvergate Bank so they can enhance their organizations’ risk management activities and meet increased regulatory expectations while also maintaining customer confidence.

5 critical components of your 2023 business strategy

In light of inflationary pressures, economic headwinds, geopolitical risk, and many conflicting so-called leading indicators, a business strategy refresh is paramount.

What does SECURE 2.0 mean for small employers?

SECURE 2.0 changes retirement plan rules for small employers with 100 or fewer employees.

ASC 740: FASB proposes new income tax disclosures

The proposal aims to improve the transparency and consistency of income tax disclosures by expanding the required disclosures around the rate reconciliation and income taxes paid.

Global financial stress: Credit Suisse to borrow $53.7 billion from Swiss central bank

The infusion by Swiss National Bank calmed global markets, but financial stress remains elevated and is likely to build in the near term as the crisis of confidence in global banks endures.

Retail sales and producer inflation fell in February

Retail sales dropped in February after surging in January, while producer inflation fell unexpectedly on the month, signaling easing demand pressures.

Understanding clean energy incentives for the automotive industry

Guidance on tax credits for personal and commercial clean vehicles will help automakers act on these clean energy incentives.

AICPA – New Service Organization Controls (SOC) Guidance

The AICPA recently released updated guidance to assist teams in implementing System and Organization Controls (SOC) 2 and 3 reports.

It’s a matter of trust: Financial conditions tighten on stability risks

The RSM US Financial Conditions Index sits at 1.4 standard deviations below neutral, indicating increases in volatility and risk priced into financial assets.

Subscribe to receive important updates from our Insights and Resources.