Insights and Resources

Content Type:

Industry:

- All

- Asset management

- Automotive

- Business and Professional Services

- Consumer Goods

- Consumer Products

- Energy

- Financial Services

- Food and Beverage

- Government

- Health Care

- Healthcare

- Hospitals and Health Systems

- Insurance Industry

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Real Estate

- Restaurant

- State and Local

- Tech Media Telecom

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Credits and Incentives

- Cybersecurity Risk

- Digital Transformation

- Federal Tax

- Financial Consulting

- Financial Management

- Global Audit

- Global Compliance and Reporting

- International Services

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Private Client

- Private Client Services

- Public Companies

- Risk Consulting

- State and Local Tax

- Tax

- Technical Accounting Consulting

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Base Erosion and Profit Shifting (BEPS)

- CARES Act

- Coronavirus

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Evolution

- Economics

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Global Compliance

- Inflation

- Labor and Workforce

- Partnership

- Payroll and Employment

- Policy

- Regulations and Compliance

- Regulatory Compliance

- SEC Matters

- Supply Chain

- Tax Reform

Navigating the Pregnant Workers Fairness Act: A guide for employers

Are you prepared for the Pregnant Workers Fairness Act (PWFA)? As an employer, it's essential to understand your responsibilities to avoid legal issues and ensure a supportive work environment for all employees. Read on to learn about the law's requirements and how to comply.

Navigating trust taxation: strategies and insights

Trusts are an essential tool for estate planning, but their tax implications can be confusing. Understand the differences between revocable and irrevocable trusts, grantor and non-grantor trusts, and simple and complex non-grantor trusts to determine which trust is best for your unique financial situation and goals.

What you need to know about tax nexus

Understanding nexus is essential for determining a company's tax obligations. However, many businesses are unaware of what establishes nexus and thus are unaware of their tax obligations. Learn about tax nexus and how it may affect your company.

Crafting a buy-sell agreement for your business

Buy-sell agreements are an essential tool for businesses with more than one owner. This type of agreement defines what will happen to the departing owner's share of the business if they leave. Learn about the benefits, key components, and important considerations of a buy-sell agreement for your business.

Breaking News: Significant Changes to Retirement Savings in the United States

Are you curious about the changes to retirement savings in the United States? The SECURE Act 2.0 brings significant changes, including raising the RMD age, reducing penalties, increasing catch-up contributions, and more.

Keep investors informed and engaged with regular updates

Providing investor updates is an essential practice for startups and established businesses alike. These updates are critical to fostering trust and maintaining strong relationships between companies and their investors. Learn about the importance of writing investor updates, how often you should send them, and what information should be included.

Understanding Revenue Ruling 2023-02: Implications for Irrevocable Grantor Trusts

The IRS issued Revenue Ruling 2023-02, which clarifies the treatment of assets in irrevocable grantor trusts for tax purposes. This ruling aims to curb potential abuse of the stepped-up basis adjustment in trust structures and has significant implications for wealthy clients engaged in advanced estate planning. Learn about the ruling and its impact on irrevocable grantor trusts.

ChatGPT could help overburdened physicians, but careful evaluation is needed

Emerging artificial intelligence technologies such as ChatGPT offer potential solutions to the challenges of patient engagement and communication for overburdened physicians and staffs.

Bonus depreciation phase-out begins January 2023

100% Bonus depreciation is a tax provision that allows businesses to deduct the cost of certain qualifying property in the year it is placed in service rather than having to depreciate the cost over several years. Unfortunately, the 100% bonus depreciation deduction will begin to phase out after 2022. Learn more about the phase-out schedule and the alternative Section 179 deduction.

Business Interest Expense: How much can you deduct?

The tax treatment of business interest expense is governed by Section 163(j) which places limits on the amount of interest businesses can deduct on their tax returns based on their income and other factors. Unfortunately, the calculation for determining a company's limit has changed starting with the tax year 2022 and stands to impact many large businesses negatively.

Measuring customer satisfaction

Measuring customer satisfaction provides a business with critical feedback, but unfortunately, many companies fail to survey their customers regularly. Learn the most common metrics and best practices for measuring your customer's satisfaction.

Properly Funding Your Living Trust

Failing to properly fund a living trust is one of the most common errors people make and can lead to unintended consequences and added costs for both the individual and their beneficiaries. In this video, we'll provide an overview of how to properly fund a living trust.

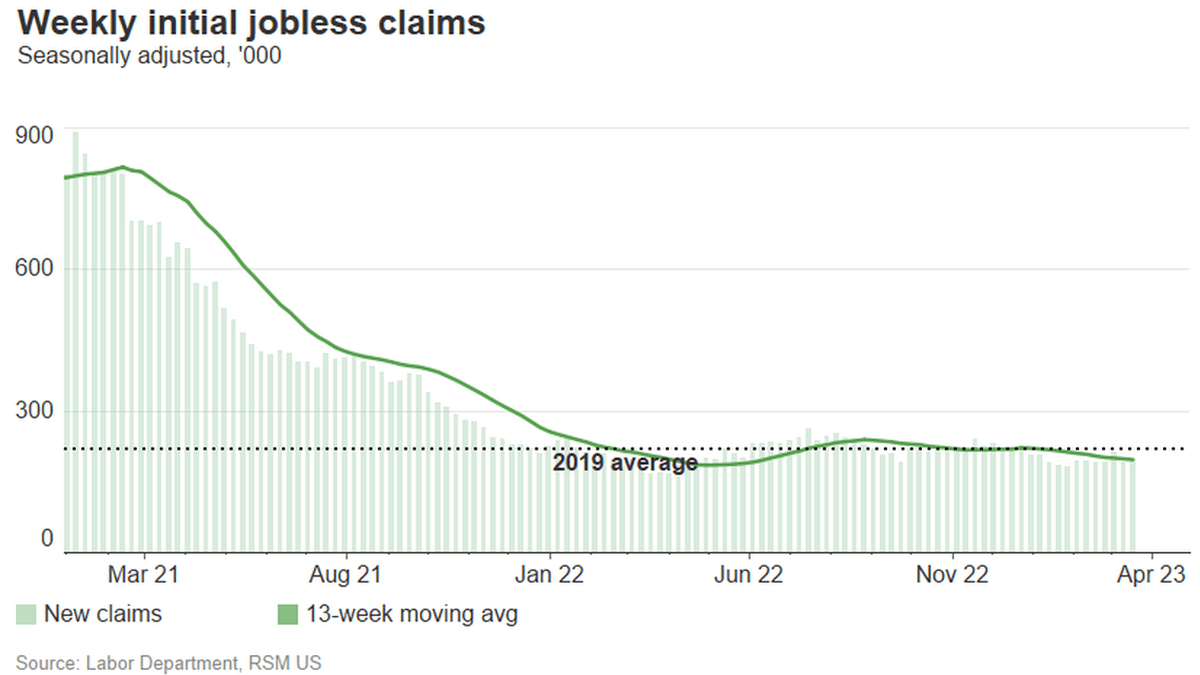

Initial jobless claims drop further

Initial claims for unemployment benefits fell by 1,000 to 191,000 last week, remaining below the pre-pandemic average and below expectations of a slight increase to 197,000.

How hedge funds achieve alignment with investors

Find out more about how hedge fund managers are adapting their business model in response to competition and the evolving mandates of investors and competition.

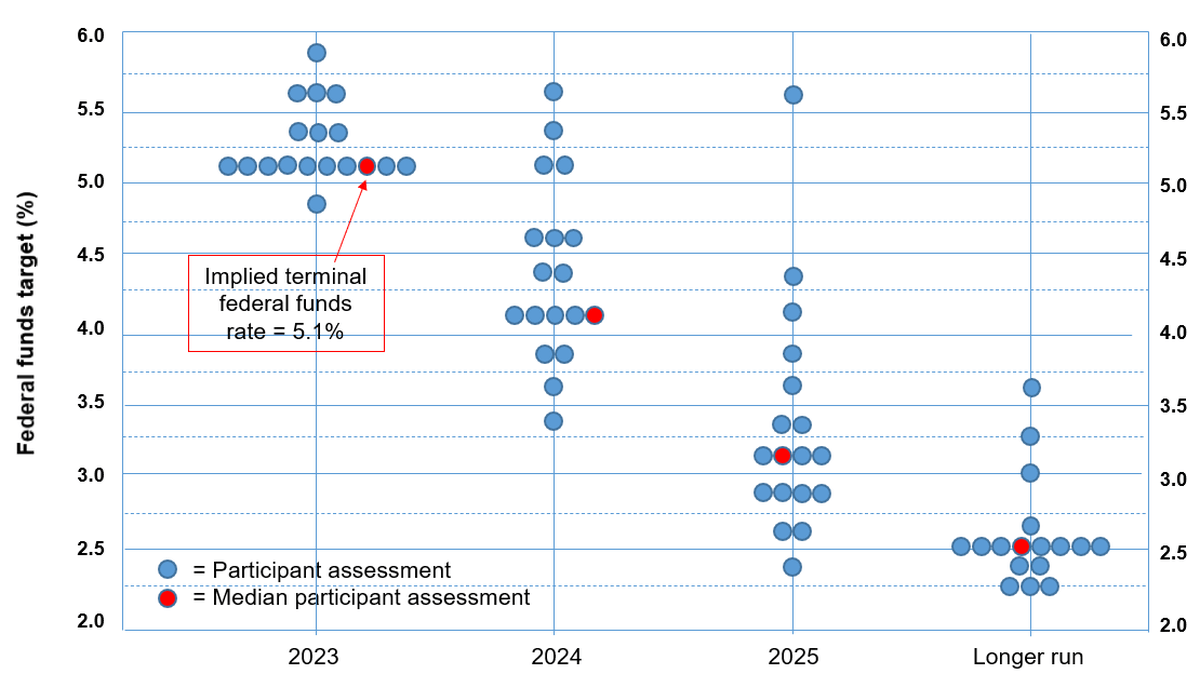

Catch-25: Fed hikes rates amid financial stability risk

The Federal Reserve finds itself as it lifted its policy rate by 25 basis points on Wednesday amid a quickly evolving global banking crisis.

Subscribe to receive important updates from our Insights and Resources.